The Fractional Banking System _____

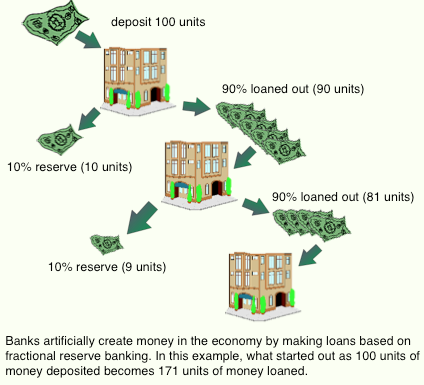

The fractional banking system _____. The system of fractional banking came into existence as an answer to problems encountered during the Great Depression when depositors made large sum of withdrawals leading to bank runs. When you deposit money into your bank account the bank does not simply hide the funds in a cash cow in the basement or elsewhere. This system is the way that virtually all modern day banks around the world operate.

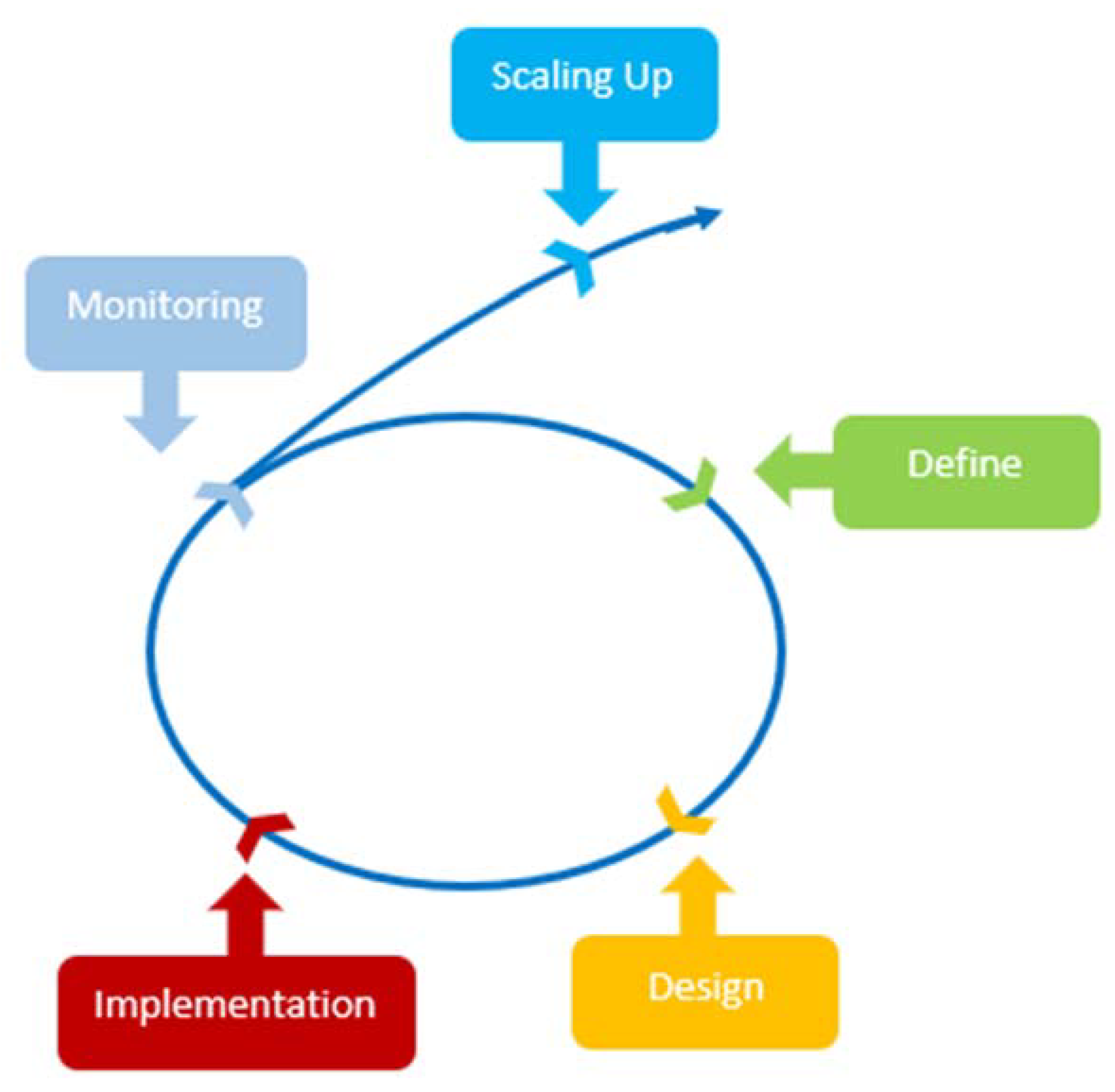

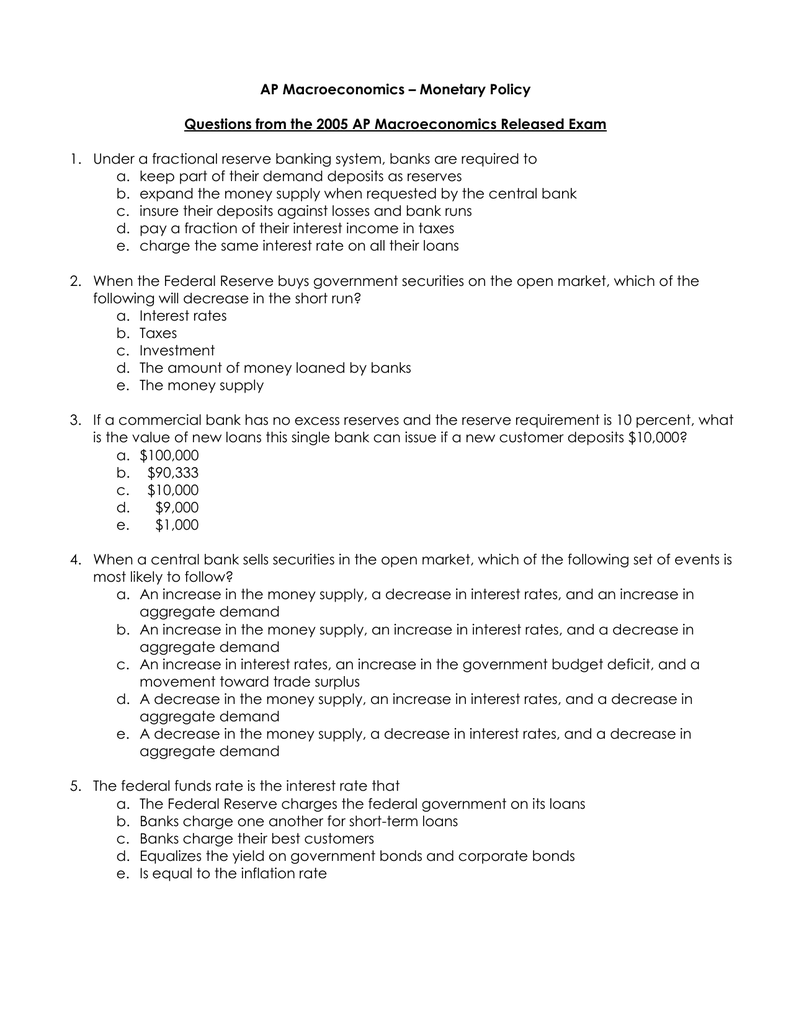

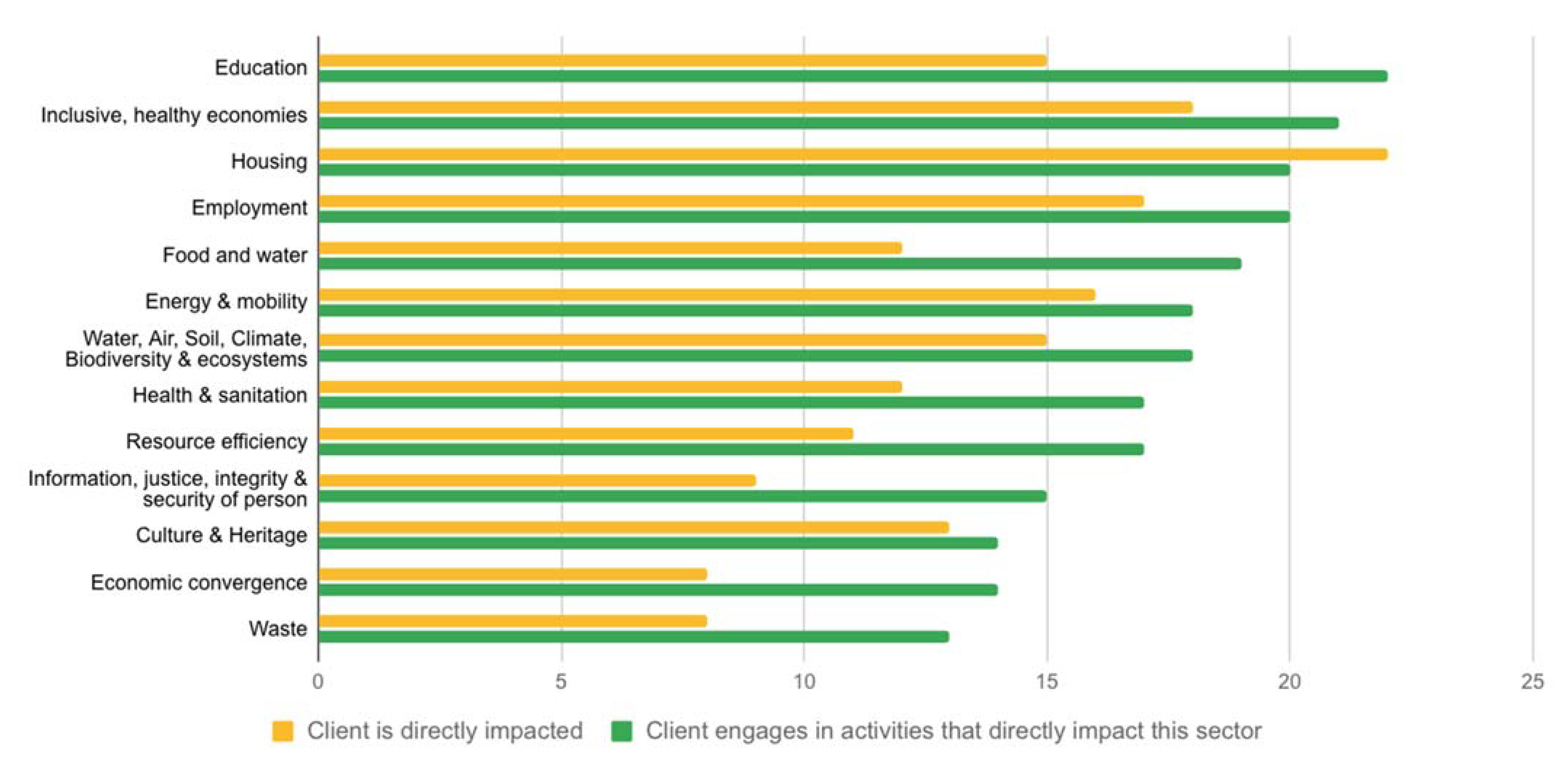

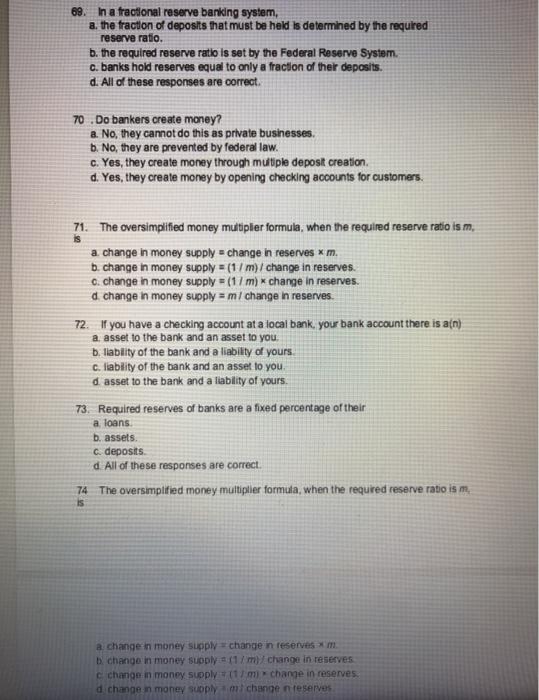

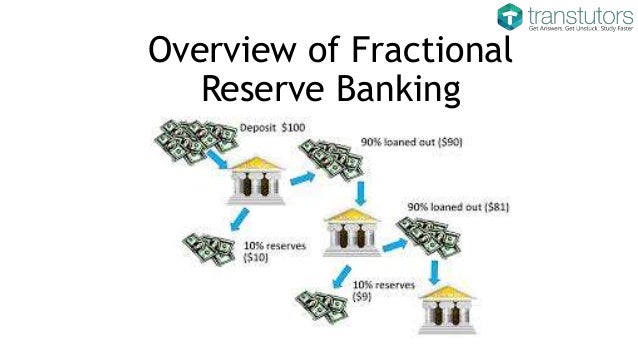

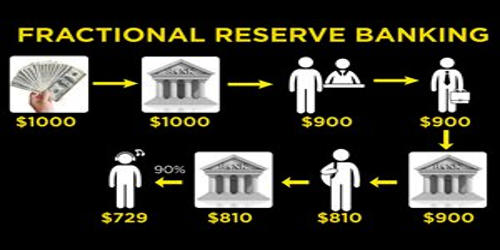

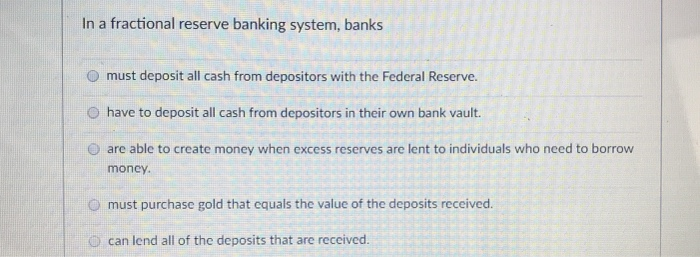

What is a Fractional Reserve Banking System. If bank customers lose confidence they are likely to try to withdraw their funds. In our modern banking system banks are only required to keep a small fraction of their deposits on reserve in case depositors wish to withdraw their deposits.

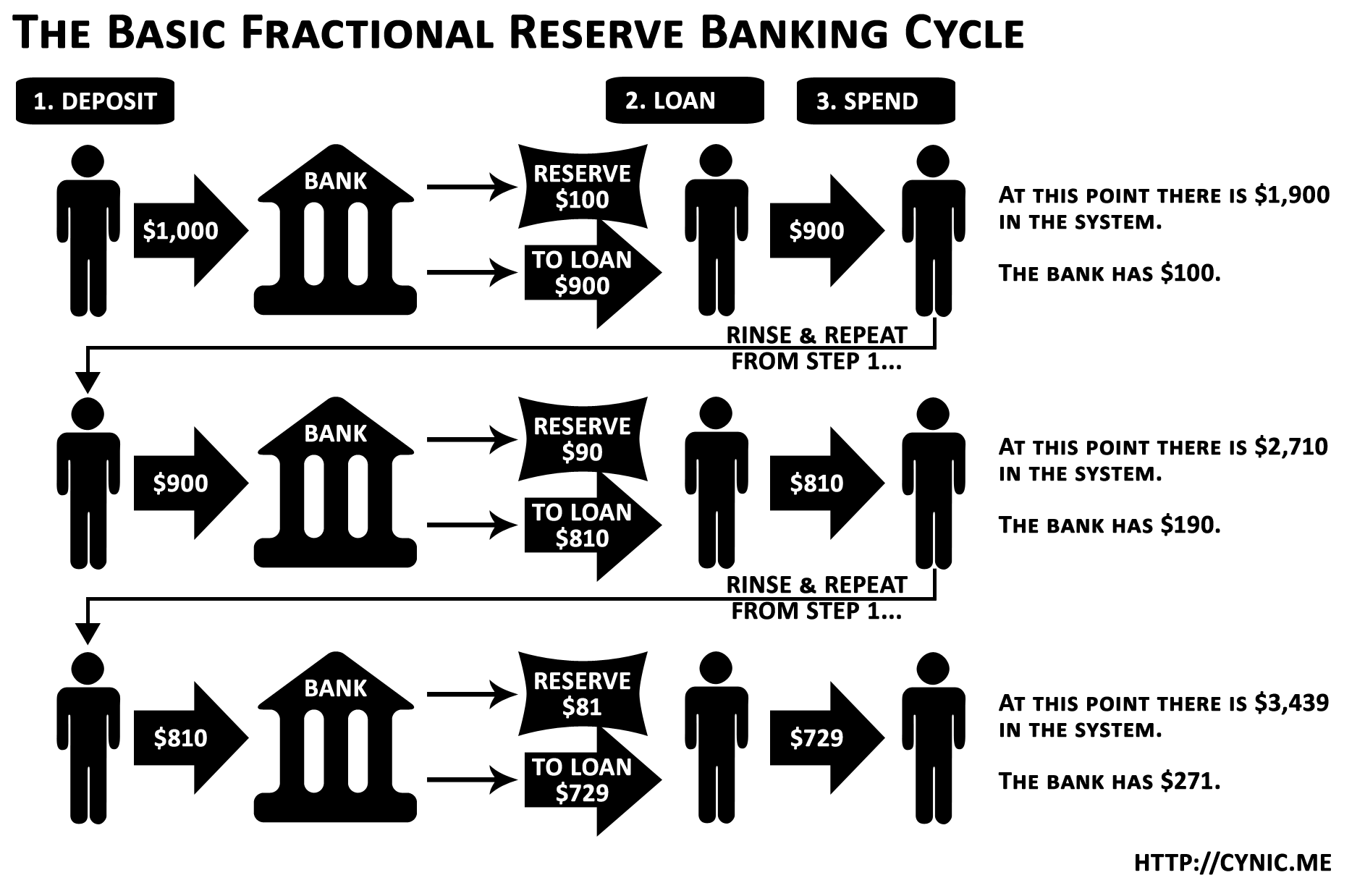

Referred to as the fractional reserve system it permits the banking system to create money. This system has undergone massive change in the past century. A fractional reserve system means that banks can operate only if their customers maintain their confidence in them.

Instead it lends your capital to the people or companies that need it. During the Great Depression banks were forced to close their doors because customers came to withdraw their funds only to find out there was no money left. This provides capital that could be loaned to others which in turn expands the economy.

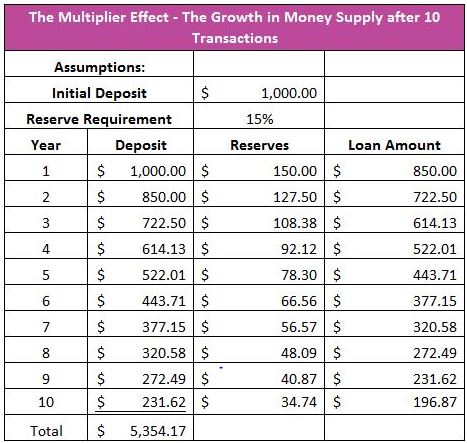

This gives commercial banks the. Fractional Reserve Banking The Banking System Explained Did you know that when you deposit money at a bank they dont necessarily store it for you. The fractional reserve system and the multiplier effect are extremely important for anyone trying to understand modern banking.

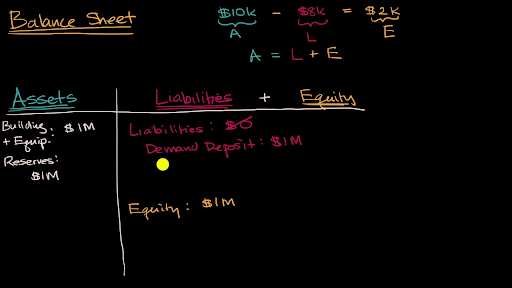

The fractional banking system a. But with a fractional reserve system a bank actually holds funds in reserve equal to only a small fraction of its deposit liabilities. Fractional-reserve banking is a system by which banks lend out their customers deposits to generate a profit through interest.

Referred to as the fractional reserve system it permits the banking system to create money. In a fractional reserve banking system banks actually only maintain a small amount of their deposited funds in reserve forms of cash and other easily liquid assets.

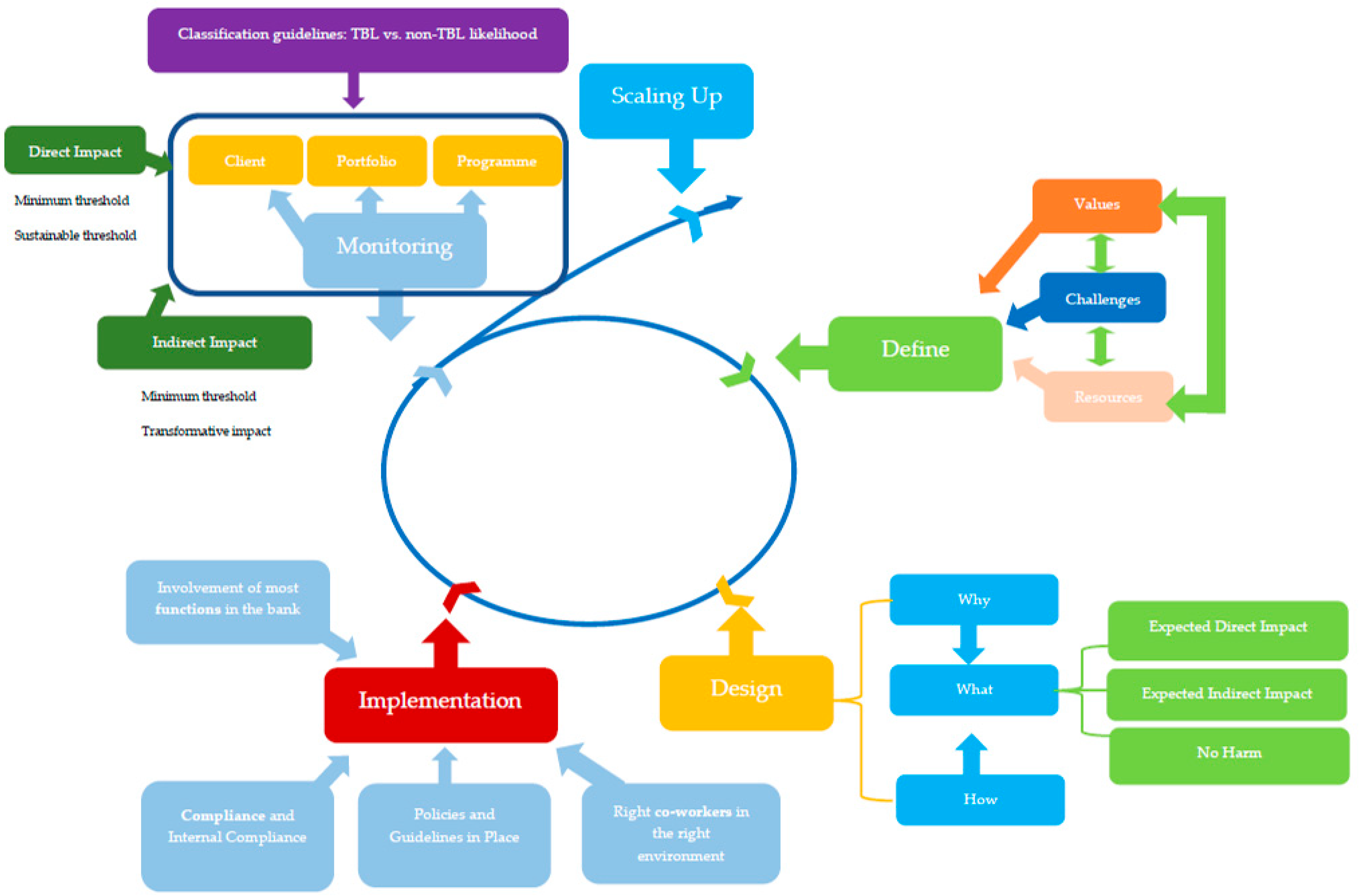

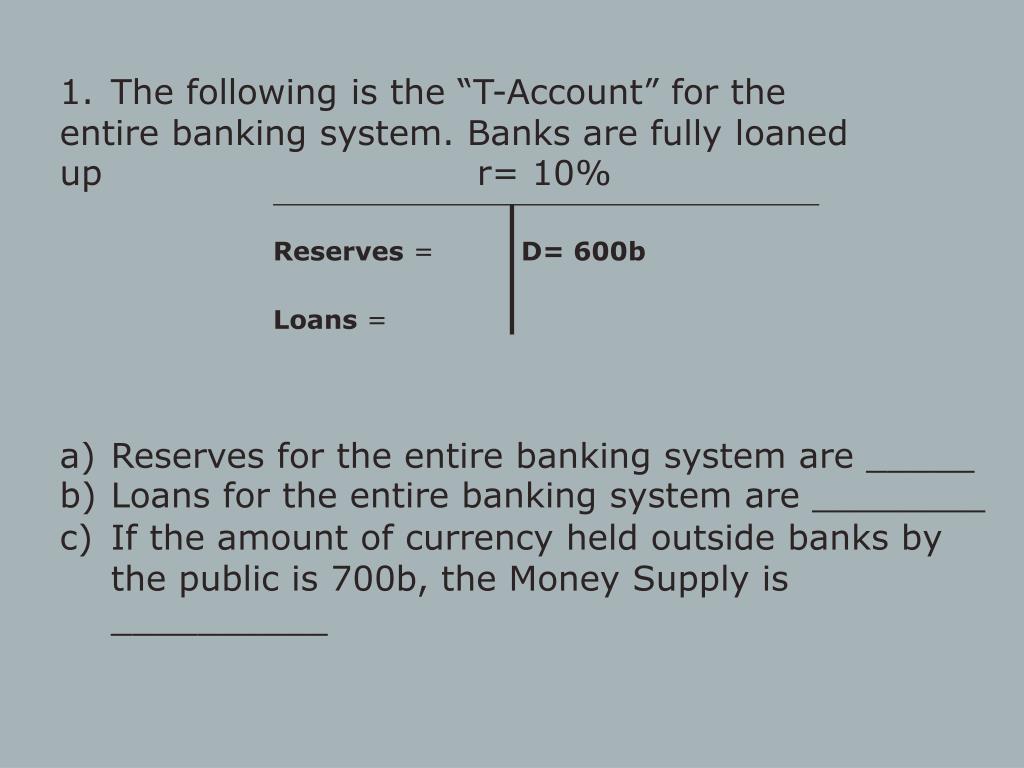

What is the role of the fractional reserve banking system in determining the money supply and the money multiplier.

The fractional banking system a. The fractional banking system a. This provides capital that could be loaned to others which in turn expands the economy. In our modern banking system banks are only required to keep a small fraction of their deposits on reserve in case depositors wish to withdraw their deposits. But with a fractional reserve system a bank actually holds funds in reserve equal to only a small fraction of its deposit liabilities. A fractional banking system is when only a portion of bank deposits are actual cash. Makes banking more secure b. Under a fractional reserve banking system banks are not required. This system is the way that virtually all modern day banks around the world operate.

The system of fractional banking came into existence as an answer to problems encountered during the Great Depression when depositors made large sum of withdrawals leading to bank runs. In a fractional reserve banking system banks actually only maintain a small amount of their deposited funds in reserve forms of cash and other easily liquid assets. Fractional reserve banking is a banking system in which banks hold a fraction of their clients deposits in reserves. This system has undergone massive change in the past century. A fractional banking system is when only a portion of bank deposits are actual cash. Instead it lends your capital to the people or companies that need it. Fractional Reserve Banking.

/dotdash_Final_Reserve_Ratio_Definition_Oct_2020-01-abeb9a9e7e894fddbbbf82dc746152f5.jpg)

Post a Comment for "The Fractional Banking System _____"